Solved: Adjust Payroll Liabilities for Taxes Already Paid

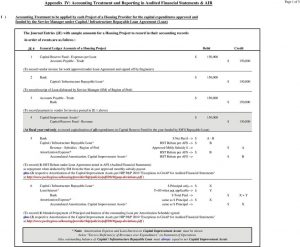

Now, let’s dive into the step-by-step process of adjusting payroll liabilities in QuickBooks Online to ensure your financial records are accurate and up to date. In summary, payroll liability adjustment pays for these overpaid or incorrectly taxed liabilities. Upon completion, the revised liabilities are accurately entered into QuickBooks, with careful attention to detail to maintain accurate financial reporting and compliance with tax regulations. In this comprehensive guide, we will explore how to adjust payroll liabilities in QuickBooks, QuickBooks Online, and QuickBooks Desktop. From identifying the need for adjustment to making necessary changes in payroll setup and reconciling liabilities, we will cover the essential steps and best practices for each scenario. Please note that adjusting payroll liabilities should be done with caution, as it can have a direct impact on your financial statements and tax reporting.

Direct Deposit Setup (if Applicable)

Quickbooks helps businesses manage payments, pay taxes, run payroll, and settle any liability for the businesses. The application works on the data entered by users, making mistakes on their part is very natural. That is one big reason why intuit developers added an option to adjust payroll liabilities in QuickBooks. The users can use the payroll adjustment liability feature to correct employees’ year-to-date (YTD) or Quarter-to-date (QTD) payroll information. Users can also make changes in company contributions, employee additions, and deductions. So, we have enclosed this blog with what payroll liabilities are in QuickBooks and how to adjust it.

Customization for Specific Needs

Integrating QuickBooks Desktop Payroll with various business systems amplifies its functionalities, enabling a seamless flow of information across different operational domains. Invest in training sessions for payroll administrators to enhance their proficiency using QuickBooks Desktop Payroll effectively. To comply with regulatory obligations, including W-2 form generation and filing, execute year-end payroll tasks. I have followed these instructions and these are still showing up in liabilities to be paid. If the Installments-Payroll account has an amount remaining at year-end, confirm with your tax agency if the remaining amount will be carry-forward to the next year.

Try the Best Construction Workforce Management App for QuickBooks

Now that you understand the process of adjusting liabilities through the Payroll Center, you can proceed confidently with making any necessary adjustments to your payroll liabilities in QuickBooks Online. Integration issues can arise for businesses using QuickBooks Desktop Payroll in conjunction with other software or third-party applications. Incompatibility between systems, data transfer errors, or challenges in syncing information seamlessly can disrupt payroll processes. Customize tax categories and settings to ensure compliance with regional tax regulations.

- First, I want to make sure your QuickBooks company file gets the full functionality of payroll updates.

- Similarly, if a new tax law is enacted, it may lead to adjustments in tax calculations and withholdings.

- Take control of your payroll liabilities in QuickBooks Online and enjoy the peace of mind that comes with accurate financial record-keeping.

Reasons To Use Payroll Liability Adjustment

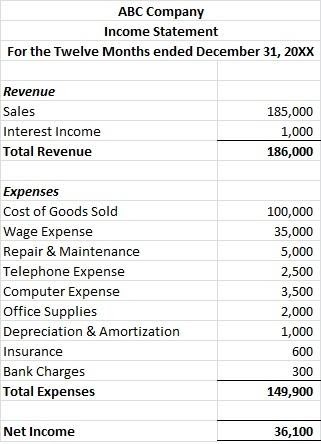

QuickBooks offers options to customize withholding rates based on the latest regulations, and it also allows flexibility in adjusting employer contributions. It is crucial to consider the implications of these changes, as they may affect employee pay, tax reporting, and overall financial management. By diligently following these steps, you can ensure that your payroll liabilities are accurately adjusted in QuickBooks Online. This will enable you to maintain accurate financial records, comply with tax regulations, and make informed decisions based on reliable payroll data. Using the Chart of Accounts to adjust payroll liabilities provides you with direct control over the specific liability accounts related to your payroll. This method offers flexibility and precision in making adjustments, ensuring that your financial records accurately reflect the necessary changes.

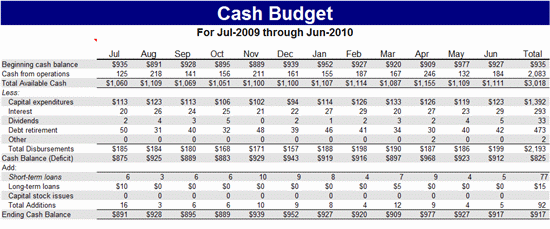

Once you have reviewed and verified the adjustments, you can proceed with running financial reports, preparing tax filings, and utilizing the adjusted payroll liabilities for accurate financial analysis. By following either option, you will be able to make the necessary adjustments to your payroll liabilities in QuickBooks Online. These adjustments will ensure that your financial records accurately reflect the changes you need to make based on the review conducted earlier. When managing payroll in QuickBooks Online, it is important to ensure that payroll liabilities are accurately recorded.

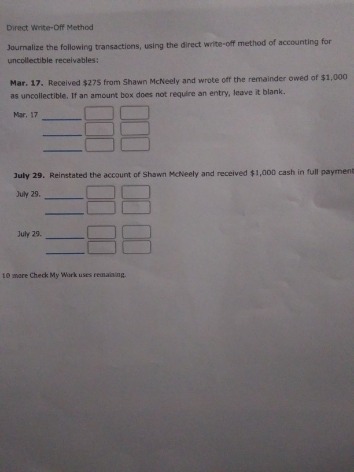

However, there may be instances where adjustments need to be made due to various reasons, such as correcting an error or reflecting changes in employee benefits. By exploring these advanced features and leveraging customization options, construction businesses can optimize their payroll processes, ensuring accuracy, compliance, and efficiency in managing financial operations. The initial step in adjusting payroll liabilities in QuickBooks Online is to identify the specific reasons or events that necessitate the adjustment, such as corrections journal entry for purchases return in tax calculations or changes in employee wage withholdings. The initial step in adjusting payroll liabilities in QuickBooks is to identify the specific reasons or events that necessitate the adjustment, such as corrections in tax calculations or changes in employee wage withholdings. It is essential to review the adjustments made in the Chart of Accounts to confirm their accuracy. You can generate payroll liability reports or review the individual liability accounts to ensure that the adjustments align with your requirements.

Here’s a step-by-step guide to help you streamline the setup process and implement best practices for optimal data entry and system configuration from day one. When it comes to QuickBooks, most users are not aware of the fact that they can adjust the payroll liabilities. Even if they are aware of it, they mostly are not aware of the right methods to do it. With this article, we will guide you on how you adjust payroll liabilities in QuickBooks.

By leveraging these tips, businesses can optimize payroll management and ensure timely and error-free financial transactions. Handle payroll taxes efficiently by staying updated on tax rates, deductions, and submission deadlines. QuickBooks Desktop streamlines tax handling, aiding in accurate tax calculations and submissions. Any changes in employee status, tax exemptions, or personal details should be promptly updated how to calculate net realizable value nrv within the system to maintain accuracy in payroll calculations and reporting. A payroll liabilities adjustment will result in a permanent change to your company file, so it is crucial to make a backup so that you have a copy of your current file in case you need it later. Any payroll-related payment that your company borrows but hasn’t yet made is referred to as the payroll liabilities adjustment in QuickBooks.

This section provides a comprehensive guide, breaking down each step in the payroll cycle process within QuickBooks Desktop for seamless financial management. Utilize QuickBooks Desktop Payroll’s customizable features to tailor settings to your business’s unique requirements. Customization options include configuring payroll reports, defining deduction items, and setting up tax categories according to specific state committed to keeping or regional regulations. You can adjust more than one liability at a time during one liability adjustment transaction by selecting the payroll items in the payroll item column provided. If you need to make adjustments for more than one period, then you must use a separate adjustment transaction for each period. Make sure that the adjustments are correct by selecting the appropriate reports when finished.

This section will show you some essential customization options, allowing you to tailor settings, deductions, tax categories, and integrations to optimize payroll operations within QuickBooks Desktop. This includes selecting pay schedules, employee payment methods, and payroll taxes. Setting up payroll in QuickBooks Desktop marks the foundational step toward efficient payroll management.

Consider consulting with QuickBooks experts or accounting professionals for complex issues requiring specialized knowledge. Efficiently manage employee benefits within QuickBooks Desktop, from healthcare plans to retirement benefits. Learn how to input, track, and manage various benefit programs to support your workforce.

Updating the withholding rates is crucial to ensure compliance with the latest tax brackets and calculations. Adjusting payroll liabilities in QuickBooks involves making changes to the recorded amounts of various payroll obligations and ensuring that the financial records accurately reflect the current liabilities and taxes owed. Nearly 30% of small business owner’s overpay their taxes every year to the state and federal tax authorities either because of the incorrect tax payment calculation or because of the fear of getting penalties from the IRS.